Local governments have limited options to raise revenue to pay for new pressures and responsibilities. There is an over-reliance on property taxation that never contemplated funding the service delivery and infrastructure gaps that are linked to provincial mandates in areas such as:

- Building new community infrastructure to support legislated housing growth.

- Funding pre-hospital care for those with mental health and addiction issues.

- Subsidizing affordable housing units to tackle housing affordability and homelessness.

These cost pressures are pushing local governments to raise taxes, rely on one-time grants, or divert funds from core local responsibilities. In the absence of uploading responsibilities back to the Province, local governments require new revenue streams to address the gaps in provincial services, to effectively implement demanding new legislation, and to continue to support the Province in tackling the most critical issues facing our communities: infrastructure deficits, housing supply and homelessness, public safety, infrastructure deficits, and climate resiliency.

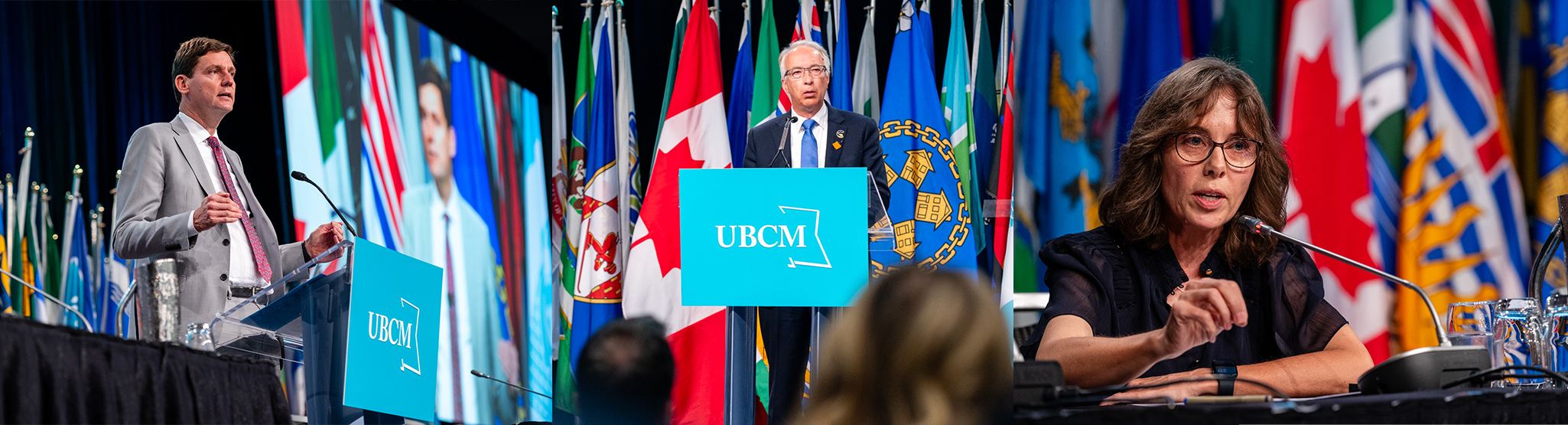

UBCM is calling for the next provincial government to address these pressures through new provincial transfers to local governments.

Read UBCM's full recommendations in STRETCHED TO THE LIMIT or see a one-page summary. Scroll down to see how each provincial party platform addresses UBCM's recommendations.

Housing & HomelessnessAll parties commit to an annual transfer of a percentage of the provincial Property Transfer Tax to support local efforts in subsidizing affordable housing supply and homelessness responses. | |

Investing in InfrastructureAll parties commit to an annual allocation-based transfer equivalent to the doubling of the Canada Community-Building Fund funding to support local capital and operating infrastructure priorities. | |

Climate Action & Emergency ManagementAll parties commit to transferring annually a percentage of the growth in the provincial carbon tax to support local climate action projects and emergency management planning and responses. |

Election Platform Analysis

This election platform tracker compares provincial party platforms directly to UBCM’s three key election priority recommendations.

Image  | ||

| INVESTING IN INFRASTRUCTURE | ||

|---|---|---|

| UBCM RECOMMENDATION: All parties commit to an annual allocation-based transfer equivalent to the doubling of the Canada Community-Building Fund funding to support local capital and operating infrastructure priorities. | ||

| BC NDP Party | BC Conservative Party | BC Green Party |

| Encourage municipal partnerships to build more housing through a new local infrastructure investment fund that’s tied to housing starts, while offering more flexibility to cities exceeding those targets. | Create the Civic Infrastructure Renewal Fund [which is a] $1 billion per year fund that will be available to municipalities who are taking action to get homes built. The funds will be available to municipalities whose zoning allows for viable Small-Scale Multi-Unit Housing on at least 2/3rds of residential land. | Provide $650 million annually in infrastructure funding to municipalities. |

| HOUSING & HOMELESSNESS | ||

| UBCM RECOMMENDATION: All parties commit to an annual transfer of a percentage of the provincial Property Transfer Tax to support local efforts in subsidizing affordable housing supply and homelessness responses. | ||

| BC NDP Party | BC Conservative Party | BC Green Party |

| The BC NDP platform does not directly address this recommendation. | The BC Conservative platform does not directly address this recommendation. | Partner with municipalities to meet housing development targets and reward successful communities by sharing a portion of the provincial property transfer tax. |

| CLIMATE ACTION & EMERGENCY MANAGEMENT | ||

| UBCM RECOMMENDATION: All parties commit to transferring annually a percentage of the growth in the provincial carbon tax to support local climate action projects and emergency management planning and responses. | ||

| BC NDP Party | BC Conservative Party | BC Green Party |

| The BC NDP platform does not directly address this recommendation. | The BC Conservative platform does not directly address this recommendation. | Direct a portion of carbon pricing revenue to local governments [to] help communities prepare for, respond to, and recover from the impacts of climate change. |

Please note that this election tracker only reviews platform items that are directly related to UBCM's recommendations for the 2024 BC provincial election.